Accédez à votre profil ⇒ Expatrié et Non Résident – Résident en France – Personne à risque médical – Sportif ou Profession à risque

Assurance de prêt Expatrié ou Non Résident

Valorama s’est spécialisé dans la sélection et la mise en place de délégations d’assurances (assurances de prêt) pour les emprunteurs étrangers ou expatriés, et généralement tout investisseur situé hors de France. En effet, les banques ne sont habitués ni en terme de garanties ni en terme de process à distance (demandant réactivité et personnels multilingues) pour couvrir ces clients de manière satisfaisantes. L’international est notre passion et nous avons mis en place des techniques adaptées pour répondre à notre clientèle atypique ou tout simplement mondiale.

Adhésion à distance, dans la langue de nos clients

Nos process sont faits à distance

- en adhésion « en ligne », de manière quasi immédiate

- en adhésion via échange d’emails, de manière très efficace et fiable.

- nous assistons nos clients de A à Z dans le process en anglais, arabe, russe, italien et espagnol.

Medical simplifié

La plupart de nos contrat d’assurance de prêt permettent une adhésion sur simple déclaratif médical

- Adhésion sans examen médical possible jusque 1M€ par assuré avant 45 ans

- Adhésion sans examen possible jusque 500K€ par assuré jusque 55 ans

- lorsqu’il y a nécessité de recourir à des examens, ceux ci peuvent être faits, à l’étranger, dans votre centre habituel sur votre lieu de résidence ou dans un de nos centres privilégiés, en langue anglaise.

Sélection des contrats par multi-critères

Afin que nos clients aient les contrats les plus compétitifs du marché tout en prenant en compte l’aspect international des clients, nous sélectionnons les contrats en utilisant des comparateurs puissants (semblables aux comparateurs des plateformes bien connues d’internet mais offrant plus de contrats car nos clients internationaux ont de fait des exigences plus fortes, notamment du fait de leur voyages et résidence évolutive dans le temps. Ensuite nous les classons selon les critères suivants :

- Ratio tarif / age

- Irrévocabilité du contrat pour couvrir dans n’importe quel pays notamment

- Facilité de mise en place à distance

- Examens faisables dans le pays

Assurance de prêt pour les personnes résidents en France

Optimiser le coût de l’assurance crédit

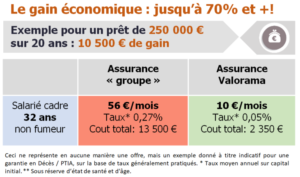

L’assurance de prêt en France représente une part conséquente du coût global du crédit et, à ce titre, il doit être recherché le meilleur prix en comparant les offres du marché. Car à garanties égales les assureurs peuvent pratiquer des tarifs allant du simple au triple. Avec un puissant outil de comparaison, Valorama compare les contrats agréés par les banques pour sélectionner le meilleur rapport qualité/prix.

Les lois Lagarde, renforcées récemment par la Loi Hamon puis l’amendement Bourquin imposent dorénavant aux banques de vous laisser l’entière possibilité de recourir à l’assurance de prêt de votre choix sans aucune contrepartie défavorable sur les conditions de votre prêt. Les banquiers appellent cela une délégation d’assurance.

Obtenir les garanties adaptées en respectant l’exigence de sa banque

Les garanties qu’offre une assurance de prêt en France sont une couverture exigée par la banque mais qui représente surtout une vraie prévoyance, si tant est que l’on sélectionne le bon contrat. C’est, en cas de maladie (remboursement des échéances) une protection de vos dépenses, et en cas de décès, une protection pour la famille ou les héritiers (remboursement de la dette).

A tarif identique, des différences considérables existent entre les contrats sur des garanties essentielles qu’il faut bien prendre en compte. Cela nécessite les conseils d’un professionnel pour en décrypter rapidement les subtilités et ne pas tomber dans les travers de contrats trop discounts et au final non adapté (qui ne rembourse pas en cas de sinistre). Il est possible de gagner 70% sur son assurance tout en ayant les meilleures garanties possibles!

Analyser un contrat et trouver le meilleur lorsque l’on s’évertue à obtenir son crédit n’est pas chose aisée pour l’emprunteur. C’est même parfois difficile : lorsque les banques font pression pour laisser penser que recourir à une assurance externe sera plus long ou moins qualitatif… Bien au contraire. Les contrats proposent aujourd’hui des packs de garanties identiques voire supérieurs aux contrats bancaires mais surtout ils sont disponibles chez Valorama dans des délais bien plus rapides : nous pouvons éviter les examens jusque 1 million d’euro par assuré, faire nos process en adhésion immédiate en ligne ou via emails.

Assurance de prêt pour personnes présentant un risque médical

Les personnes présentant une pathologie dite « aggravée » se rendent compte parfois (trop) tard, de la difficulté de trouver un assureur capable de les couvrir. En effet, cette recherche nécessite une attention toute particulière et une démarche un peu plus appuyée afin que les médecins conseils des assureurs appréhendent le risques de manière sereine et favorable. On ne trouve pas une telle assurance dans l’urgence : dans le doute les assureurs préféreront refuser un risque plutôt que de l’accepter dans la précipitation. Chez Valorama nous savons travailler ces dossiers de manière soutenue afin d’éviter au maximum les refus, ajournements ou exclusions de garanties, qui mettraient en péril l’opération chère à nos clients. Spécialiste en assurance de prêt, nous avons développé depuis longtemps des process efficaces en matière de recherche de couverture des risques aggravés médicaux. Dans ce type de cas, nous proposons :

Deux process différents en fonction du niveau de besoin du client.

- étude ciblée auprès de 1 à 2 assureurs les plus habitués au risque

- multi-étude poussée auprès d’un grand nombre d’assureurs

Valorama peut mettre votre dossier en priorité et solliciter plusieurs assureurs en une seule démarche. Ceci permet de concentrer au maximum les efforts de nos clients et de consulter un maximum d’assureurs en un minimum de temps et de formalités médicales. Cette formule est très efficace pour obtenir 1) la totalité ou un maximum des garanties exigées par la banque (car c est bien cela le problème crucial) et 2) en étant sur d’obtenir le tarif le plus compétitif. Le grand nombre d études auprès de médecins différents permet d’avoir souvent de bons tarifs.

Demandez nous un tarif et sélectionnez « multi-étude » comme objectif en bas du formulaire en ligne

Assurance de prêt pour sportifs et professions à risque

Professions à risque

Parmi nos nombreux contrats sélectionnés, nous proposons des assurances de prêt acceptant nos clients sans distinction de profession, ou bien ouvert à couvrir des professions dites « à risques ».

Sportifs professionnels ou intensifs

La pratique des sports demande une prise en compte parfaite afin que votre passion ou métier puisse être parfaitement couvert. Généralement les contrats les plus agressifs en terme de tarif excluent la pratique intensive de sports ou bien la pratique de sports dits à risques. Cela n’implique pas, comme généralement les clients le pensent, que les contrats spécialisés soient plus chers, ils seront juste sélectionnés avec d’autres critères et donc mieux adaptés. La sélection du contrat est donc cruciale pour que vous ayez le meilleur tarif avec une totale prise en compte de votre passion.