Nouveau taux d’usure: les conséquences pour les emprunteurs

Le taux d’usure est censé protéger l’emprunteur contre les taux excessifs lors qu’il fait sa demande de prêt immobilier à une banque. Chaque trimestre, la Banque de France analyse les taux effectifs moyens pratiqués par les organismes de crédit et détermine le seuil à ne pas dépasser. Le TAEG ( taux annuel effectif global) qui représente le cout total du crédit doit impérativement être en dessous du taux d’usure, sinon la demande de prêt est refusée.

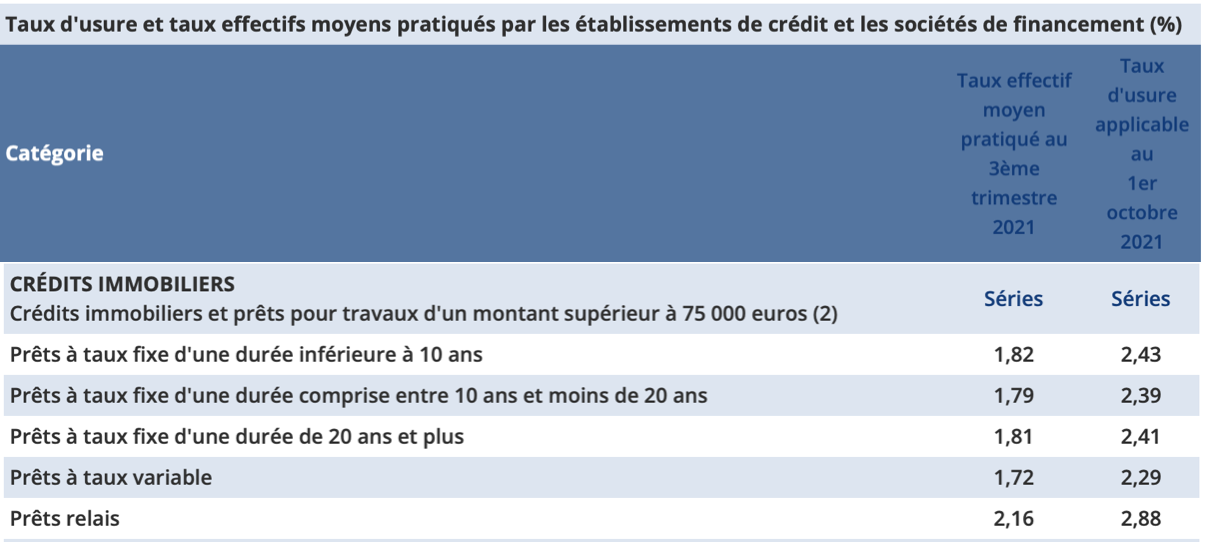

Le 30 septembre dernier le taux d’usure a de nouveau été abaissé. Ce taux maximum au-delà duquel une banque n’a pas le droit de prêter n’a jamais été aussi faible. Cependant, cela risque de pénaliser de nombreux ménages qui ne bénéficient ni des meilleurs taux d’intérêt, ni d’un taux d’assurance de prêt compétitif.

Taux d’usure pour les crédits immobilier 2021T4

*Source Banque de France

*Source Banque de France

De ce fait, plusieurs catégories d’emprunteurs sont exposés au refus de leur dossier, en raison d’un dépassement probable du taux d’usure. Par exemple, les seniors, les emprunteurs présentant un risque aggravé de santé, exerçant un métier dangereux ou pratiquant un sport à risques. Ces types d’emprunteurs se voient souvent appliquer des surprimes lors de la souscription à une assurance de prêt immobilier ce qui ramène à une forte augmentation de leur TAEG.

Représentant une grosse part de votre crédit immobilier (entre 30 et 50%), l’assurance de prêt peut être la cause du dépassement du taux d’usure. Cependant, il est possible de faire baisser le TAEG de son prêt en sortant du contrat groupe systématiquement proposé par la banque et en faisant la délégation d’assurance auprès d’un assureur qui sera adapté à votre profil.

En comparant plusieurs offres d’assurance, vous pouvez réduire de manière significative le taux global de votre crédit et même faire d’importantes économies.

Pour cela il ne faut pas hésiter à négocier avec la banque la délégation d’assurance et faire un appel à un courtier spécialisé, comme Valorama, qui pourra analyser les tarifs d’un nombre important d’assureurs, mais aussi sélectionner les meilleures solutions au vue de votre profil.